Why NETBANK?

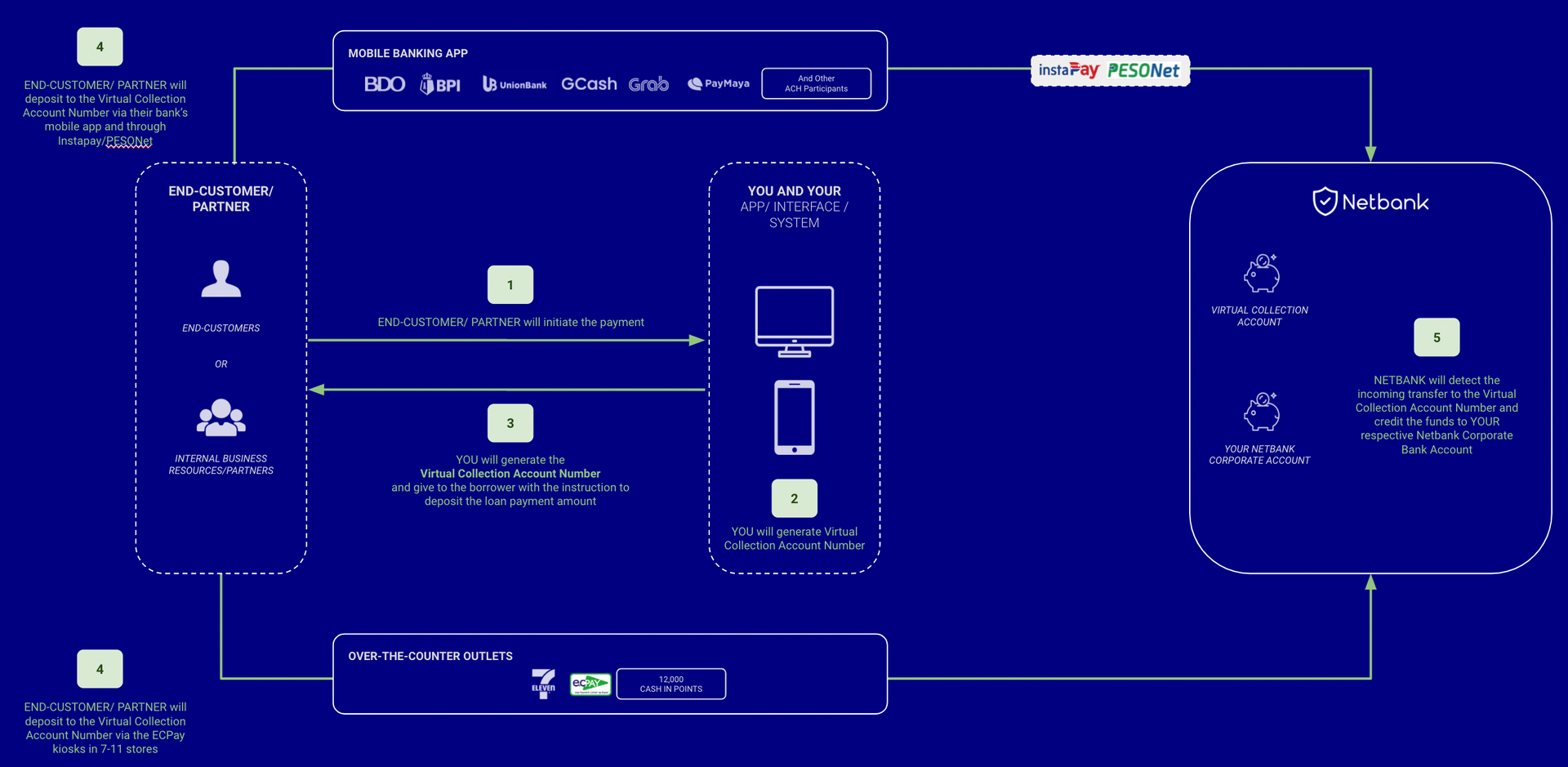

Direct connection to the Bank Transfer and Payment rails

We are a direct participant of Instapay and Pesonet which means these Virtual Collection Account Numbers are recognizable within the bank transfer rails

Holistic Solutioning Approach

We have a dedicated team that will closely listen and work with you to understand your requirements to come up with a holistic solution with our other products and services (such as attaching these transactions to collect and accounts for an end-to-end cashflow). Single partnership, agreement, and integration-point but a wider solution coverage.

Direct connection to alternative payment collection points

We have a direct engagement and integration to over-the-counter payment collection channels such as ECPay kiosks within 7-11 convenience stores, pawnshops, etc.

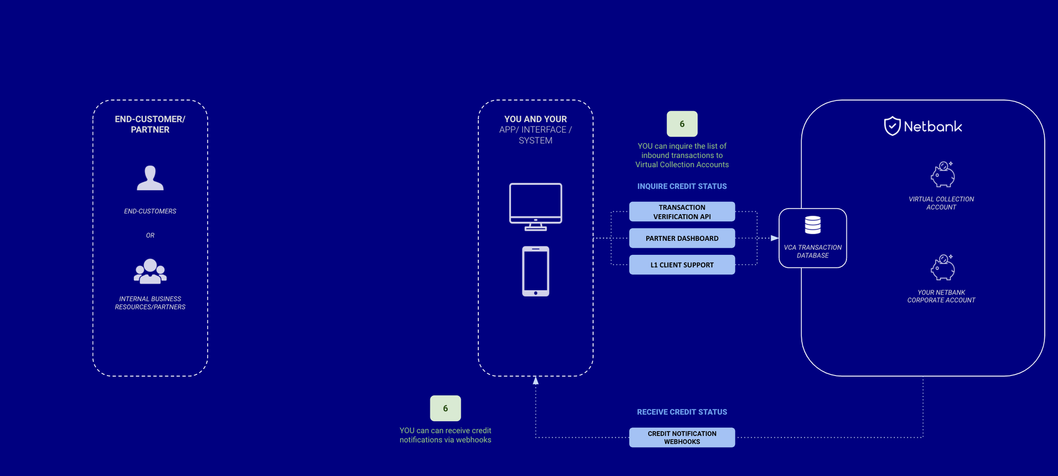

Reliable Service accompanied with auxiliary tools and services

We provide complementary tools such as webhooks, transaction verification API, and a Partner Dashboard to provide multiple ways to track and reconcile transactions.

Simple and light solution

The implementation is simple and requires minimal integration which will allow a straightforward and easy-to-follow onboarding process to support quick Go-To-Market timelines.

End-to-End Support Team dedicated to the Payout Service

We have a complete end-to-end support team dedicated to this service + a complete ticketing system to ensure quick response times and constant updates to any concern because we completely understand that the client’s transactions are highly sensitive.